https://www.bradymartz.com/wp-content/uploads/2025/02/AdobeStock_228717876.jpeg

5304

7952

Justin Burchill

https://www.bradymartz.com/wp-content/uploads/2018/01/brady-martz-logo-green.png

Justin Burchill2025-02-21 20:47:302025-02-19 21:10:03Adapting to Industry Shifts: How Auto Dealerships Can Prepare for Changing Consumer Preferences

https://www.bradymartz.com/wp-content/uploads/2025/02/AdobeStock_228717876.jpeg

5304

7952

Justin Burchill

https://www.bradymartz.com/wp-content/uploads/2018/01/brady-martz-logo-green.png

Justin Burchill2025-02-21 20:47:302025-02-19 21:10:03Adapting to Industry Shifts: How Auto Dealerships Can Prepare for Changing Consumer Preferences https://www.bradymartz.com/wp-content/uploads/2025/02/AdobeStock_228717876.jpeg

5304

7952

Justin Burchill

https://www.bradymartz.com/wp-content/uploads/2018/01/brady-martz-logo-green.png

Justin Burchill2025-02-21 20:47:302025-02-19 21:10:03Adapting to Industry Shifts: How Auto Dealerships Can Prepare for Changing Consumer Preferences

https://www.bradymartz.com/wp-content/uploads/2025/02/AdobeStock_228717876.jpeg

5304

7952

Justin Burchill

https://www.bradymartz.com/wp-content/uploads/2018/01/brady-martz-logo-green.png

Justin Burchill2025-02-21 20:47:302025-02-19 21:10:03Adapting to Industry Shifts: How Auto Dealerships Can Prepare for Changing Consumer Preferences

Tax Planning for Construction Projects: Maximizing Deductions and Credits

Tax planning is crucial for construction companies to ensure…

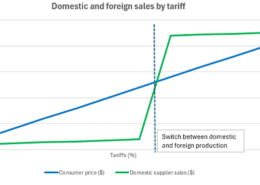

The Impact of Tariffs: Balancing Costs, Supply Chain and Profitability

Higher tariffs can raise costs regardless of the supplier. To maintain profitability, businesses should improve efficiencies and adjust prices across products.

Regulation B Section 1071: Implementation Best Practices for Financial Institutions

The financial industry is facing a significant shift with the…

Risk Assessments – Not a One and Done

In today’s ever-changing business environment, organizations…

Mitigating Cybersecurity Risks in the Financial Sector: Best Practices for 2025

As financial institutions continue to digitize their services…

Higher Tariffs Are on the Way – Can Your Company Manage the Damage?

As U.S. tariffs continue to rise, importers face mounting financial…

Organizations Dependent on Federal Funding Need to Consider Options

Organizations relying heavily on federal funding are especially vulnerable and should consider best practices to mitigate liquidity and financial risk due to...

2025 Forecast: What Financial Institutions Can Expect in the Coming Year

As we step into 2025, the financial services industry is poised…

Business Valuation in 2025: The Hidden ROI of Knowing Your Company’s Worth

When most business owners think about valuations, they picture…

Preparing to Sell in the New Year: Top Sell-Side Risks — And How to Address Them

For most business owners, selling a company is a once-in-a-lifetime…

Building the Future: How Succession Planning Sets Your Business Up for Long-Term Success

For many business owners, “succession planning” sounds like…

Key Trends in Public Administration for 2025

As we step into January 2025, government agencies are gearing…

Building a Sustainable Future: A Guide to Nonprofit Endowments

Nonprofits are constantly challenged to balance their current…

Fundraising in 2025: Creative Strategies to Engage Donors in a Digital Age

In an increasingly digital world, nonprofit organizations face…

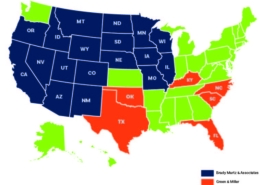

Brady Martz Welcomes Green & Miller

Brady Martz & Associates is excited to announce that the…

Streamlining Dealership Operations: Leveraging Software to Stay Ahead in the New Year

As dealerships face mounting pressure to improve efficiency,…

Kickstarting 2025: Tax Strategies for Dealerships to Maximize Early-Year Savings

As the calendar turns to 2025, dealerships across industries—whether…

Financial Transparency for Non-Profits: Best Practices for Building Donor Trust

Trust is the cornerstone of any successful nonprofit. Donors…

The Road Ahead: Key Trends Transforming Auto Dealerships in 2025

The automotive industry continues to evolve at a rapid pace,…